The judgment concerning Arvind Kejriwal's arrest revolves around his alleged involvement in the offence of money laundering related to the Delhi Excise Policy 2021-2022. Kejriwal, the Chief Minister of Delhi, was arrested by the Directorate of Enforcement after a search at his official residence on the grounds that he played a crucial role in the formulation and implementation of the said policy, which allegedly favored certain business entities in exchange for kickbacks. The policy, as per the Directorate of Enforcement's claims, led to significant financial gains for these entities, parts of which were purportedly used for the Aam Aadmi Party's election campaign in Goa.

|

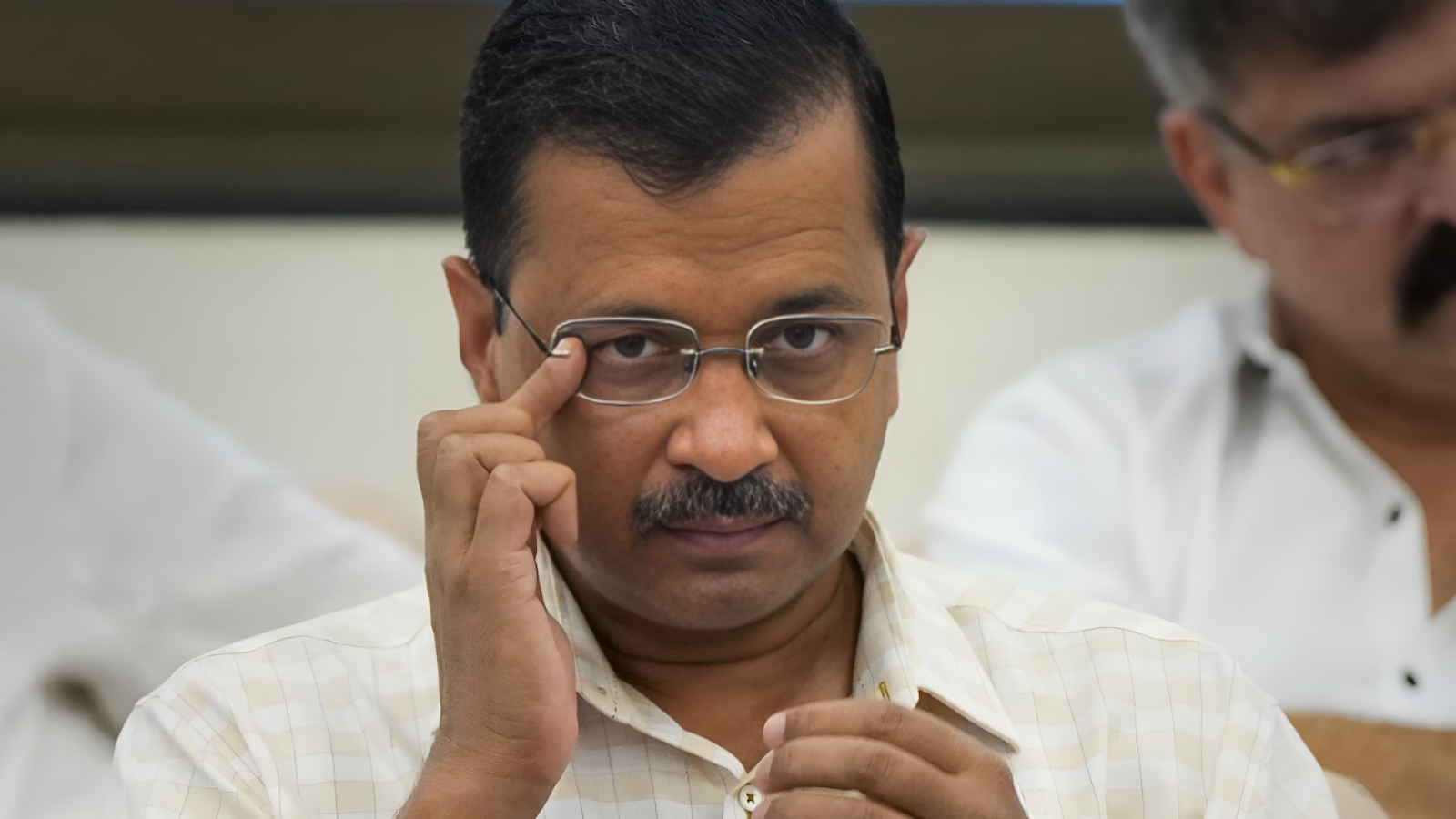

| Arvind Kejriwal |

FORMULATION OF DELHI EXCISE POLICY 2021-2022

The Delhi Excise Policy 2021-22 was formulated with the intent to overhaul the liquor sale and distribution system in Delhi. There are several key reasons behind such policy reforms such as:

1. Revenue Generation: Excise duty on alcohol is a significant source of revenue for state governments in India. Updating the excise policy can optimize revenue collection by making the system more efficient, plugging loopholes that may lead to revenue leakage, and ensuring a fair pricing mechanism that benefits the state.

2. Streamlining Distribution: The policy aimed to streamline the distribution system of liquor in Delhi, which had been criticized for being outdated, inefficient, and prone to malpractices. Streamlining distribution not only makes the system more transparent and accountable but also improves consumer access to legal and safe alcoholic beverages.

3. Curbing Illicit Liquor: One of the significant challenges in the alcohol trade is the presence of illicit liquor, which poses severe risks to public health and safety. A well-crafted excise policy can curb the sale and distribution of illicit liquor by providing a regulated and monitored framework for the legal liquor trade.

4. Promoting Responsible Consumption: An updated excise policy can include provisions for promoting responsible alcohol consumption among the populace. This may involve regulations around the advertisement of alcoholic beverages, setting up of de-addiction centers, and awareness campaigns about the dangers of alcohol abuse.

5. Adapting to Market Changes: The alcohol market is dynamic, with changing consumer preferences and the introduction of new products. An excise policy needs to adapt to these changes to remain relevant and to ensure that the regulatory framework supports a healthy market environment.

6. Ensuring Quality Control: By regulating licenses for manufacture, sale, and distribution of liquor, the policy ensures that only quality products reach the market. This is crucial for consumer safety and maintaining public health standards.

7. Enhancing Consumer Experience: Part of the motivation behind reforming the excise policy can also be to enhance the consumer experience by ensuring a wider selection of liquor is available through legal channels, improving the retail environment, and making purchasing more convenient.

The drafting of the Delhi Excise Policy 2021-2022 was likely influenced by a combination of these reasons, with the overarching goal of creating a more modern, efficient, and consumer-friendly liquor trade system in Delhi.

ALLEGATIONS OF KICKBACK

- It is alleged that kickbacks amounting to approximately Rs. 100 crores were demanded by Kejriwal and his associates from the South Group in exchange for favorable treatment in the excise policy.

- A part of the alleged kickback, about Rs. 30 crores, was reportedly agreed upon and partially paid to intermediaries linked to the Aam Aadmi Party (AAP) and the policy decision-makers.

THE "SOUTH GROUP"

The "South Group" refers to a conglomerate of business entities and individuals from South India involved in the liquor industry. Notable figures mentioned in relation to the group include K. Kavitha (associated with political figure Kalvakuntla Chandrashekar Rao), Magunta Srinivasulu Reddy (a Member of Parliament), and his son Raghav Magunta.This group is accused of engaging with key Delhi government officials and the Chief Minister to influence the Excise Policy 2021-22 to their advantage.

MEDIATORS BETWEEN THE SOUTH GROUP AND ARVIND KEJRIWAL

- K. Kavitha: She is mentioned as a key figure allegedly acting as a bridge between the South Group and Delhi government officials. Her role was purportedly pivotal in negotiating the terms of the kickbacks and ensuring the policy was tailored to benefit the group.

- Vijay Nair: Associated with the AAP, he is alleged to have been involved in the negotiations and arrangements regarding the policy manipulation and handling of the kickbacks.

- Manish Sisodia: The then Deputy Chief Minister and a close associate of Kejriwal, is also implicated in facilitating these arrangements, though his role appears more directly related to the policy's formulation and implementation.

These individuals, among others, are alleged to have played crucial roles in the negotiation, payment, and laundering of the kickbacks, ensuring that the transactions remained obscured and the benefits to each party were realized without attracting immediate legal scrutiny.

MECHANISM OF ALLEGED MONEY LAUNDERING

The core of the money laundering allegations involves kickbacks paid by the South Group to secure favorable treatment in the Delhi Excise Policy.

It's alleged that these kickbacks were disguised as legitimate transactions or routed through various channels to conceal their origin and purpose.

The kickbacks purportedly paid to influence the excise policy were allegedly funneled into political campaigns and activities, particularly those of the Aam Aadmi Party (AAP).

This not only helped in laundering the proceeds of the kickbacks but also provided financial support to the party's activities, further blurring the lines between legitimate political funding and proceeds from corrupt practices.

To facilitate these transactions and avoid detection, cash payments and a network of intermediaries were allegedly used. This method complicates tracing the money trail and establishing a direct link between the kickbacks and their utilization.

Statements from individuals such as C. Arvind (former Secretary to Manish Sisodia) and others involved in the policy formulation and execution provided insights into the alleged quid pro quo.

Details of financial transactions, meetings, and communications between the parties involved were gathered as part of the investigation to establish the money trail and the policy's manipulations.

INTEREST OF THE SOUTH GROUP IN DELHI EXCISE POLICY

The Delhi Excise Policy 2021-2022 opened up the liquor market in Delhi to private players, making it a lucrative opportunity for established business groups looking to expand their market presence, especially those from regions with a strong base in the liquor industry.

Allegations suggest the policy was manipulated to include provisions that would specifically benefit the South Group, such as more favorable terms for procurement, distribution, and retailing of liquor. This could significantly increase their profits and market dominance in Delhi.

SERIES OF EVENTS IN SUMMARY

Formulation of the Delhi Excise Policy 2021-2022:

The policy was allegedly drafted with provisions specifically tailored to benefit certain business groups, notably referred to as the "South Group," by allowing them favorable market access and terms in the Delhi liquor market.

Negotiation of Kickbacks:

Representatives from the South Group and intermediaries allegedly engaged in negotiations with officials from the Delhi government and the AAP. The negotiation was for kickbacks in exchange for these favorable policy provisions. The demanded and agreed-upon amounts were to ensure that the South Group could operate profitably under the new policy.

Payment of Kickbacks:

The agreed kickbacks were reportedly paid through intermediaries in cash or through convoluted transactions designed to obscure the source and purpose of the funds. These transactions are alleged to have been made to individuals or entities associated with the AAP and those in positions to influence the policy.

Laundering the Kickbacks:

The kickback money, considered proceeds of crime, needed to be laundered to appear legitimate. This involved channeling the funds into the political and electoral activities of the AAP, purportedly to use in their campaign efforts for the elections in Punjab and Goa, among other expenditures.

The laundering process involved breaking down the large sums of illicit money into smaller, less conspicuous amounts that were then deposited into the bank accounts of various entities and individuals. These funds were then used for expenses and contributions that appeared unrelated to the original corrupt activities, thus laundering the money.

Utilization of Laundered Money:

The laundered money was used in ways that furthered the interests of the AAP, thereby completing the laundering process. The money, now distanced from its original source, supported the party's activities under the guise of legitimate political contributions and expenses.

WHY ED CONSIDERS THIS AS MONEY LAUNDERING

The ED's interest in this case as money laundering stems from the characteristics of the financial activities involved:

- Proceeds of Crime: The initial receipt of kickbacks in exchange for policy favors constitutes the generation of proceeds of crime, as defined under the PMLA.

- Concealment and Layering: The complex series of transactions designed to obscure the origin and ownership of these proceeds meets the criteria for the concealment phase of money laundering.

- Integration: The final use of these funds for political campaigns or other seemingly legitimate purposes completes the laundering process by integrating the illicit money into the legitimate economy.

- Violation of PMLA: The activities directly contravene the PMLA, which aims to prevent money laundering and contains provisions for punishing those involved in such activities. The act of manipulating policy for financial gain, followed by the laundering of those gains, falls squarely within the scope of what the PMLA seeks to combat.

NOTE: The Prevention of Money Laundering Act (PMLA) is a law enacted by the Parliament of India in 2002 to prevent money-laundering activities and to provide for the confiscation of property derived from, or involved in, money laundering. The PMLA and the rules notified under the act came into effect from July 1, 2005.

A THREAT TO DEMOCRACY AND NATIONAL SECURITY

The case against Arvind Kejriwal and the involvement of the South Group in manipulating the Delhi Excise Policy 2021-2022 for personal gain underlines a grievous threat to democracy and national security.

When elected officials, tasked with safeguarding the public interest, allegedly engage in corrupt practices for personal or political gain, it erodes trust in public institutions. Such actions not only compromise the integrity of governance but also endanger the very fabric of democracy by prioritizing private over public interest.

Moreover, the sophisticated methods employed in this alleged scheme — involving kickbacks, money laundering, and policy manipulation — highlight vulnerabilities in our financial and political systems that can be exploited by those with nefarious intentions. This not only undermines the rule of law but also poses a significant risk to national security.

By diverting public resources for personal gain, corrupt politicians can weaken the state's ability to provide essential services, thereby eroding its legitimacy and authority. Hence in the broader context, the case exemplifies how political corruption can serve as a gateway for further illicit activities, including money laundering and financial fraud, which can have far-reaching implications beyond the immediate political sphere. It underscores the urgent need for robust mechanisms to ensure transparency, accountability, and integrity in public office to safeguard the principles of democracy and the security of the nation.

Disclaimer: This article is written for social awareness based on High Court Judgement, including the chargesheet and evidence presented by the Enforcement Directorate of India. Should this case progress to the Supreme Court, our interpretations and the representations of the documents 'may not' account for further legal developments or outcomes. Additionally, this article was specifically composed in response to various YouTubers who have been manipulating facts and attempting to sway public opinion according to their political ideologies or in line with the interests of their financiers. Our aim is to provide a clear, unbiased account based on legal documents and evidence to counteract any misinformation and prevent potential brainwashing.

Written By:

Vishal Sharma | Abhinav Kumar Singh

Comments

Post a Comment

Thank you for taking the time to share your thoughts! We value your input and encourage a respectful dialogue among our readers. Please note that we have a strict policy against abusive language, hate speech, and any form of harassment. Comments that fail to adhere to this policy will be moderated or removed to maintain a positive and constructive community discussion. Let's keep our conversations insightful and courteous